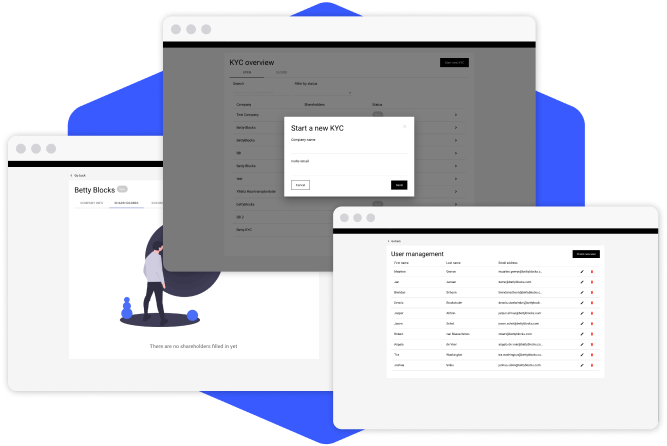

Know Your Customer App

Optimize and secure the process of verifying your potential customers’ identity through a digitized Know Your Customer (KYC) Application.

Optimize and secure the process of verifying your potential customers’ identity through a digitized Know Your Customer (KYC) Application.

Find everything you need to know about this use case right here

Find everything you need to know about this use case right here

Find everything you need to know about this use case right here

© Copyright 2025. All rights reserved.