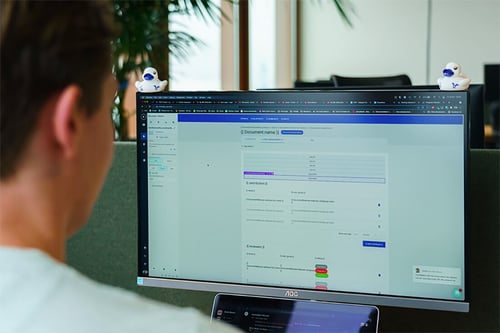

DAC6 Assessment Tool

Automate, secure, and digitize your compliance with cross-border tax agreements through a DAC 6 Assessment Tool.

Create a DAC6 assessment tool that is bespoke for and customizable to the exact needs and requirements of your organization. Add in functionalities and integrations which facilitate your end-to-end process, and make adjustments whenever required.

Perform all of your compliance assessments and reporting through one centralized, automated, optimized, cloud-based application.

Integrate your DAC6 assessment tool seamlessly with your existing infrastructure, applications, and data sources.

Find everything you need to know about this use case right here

Find everything you need to know about this use case right here

Find everything you need to know about this use case right here

© Copyright 2025. All rights reserved.